3 Mar 2025

Understanding retail investor flows is crucial, but cutting through market noise is challenging. VandaTrack delivers daily, actionable insights on retail data and positioning—so you can make decisions with conviction.

There’s no ignoring the retail crowd but separating the signal from the noise is a challenge in today’s complex markets. VandaTrack provides a unique, daily view of retail investor positioning and flow, offering the clarity and depth needed to anticipate market shifts before they happen.

Be proactive instead of reactive

Market data is everywhere, but true insight is rare. VandaTrack covers over 10,000 listed stocks and ETFs in the US, transforming complex retail investor positioning and flow data into a clear actionable narrative - so you can make decisions with conviction.

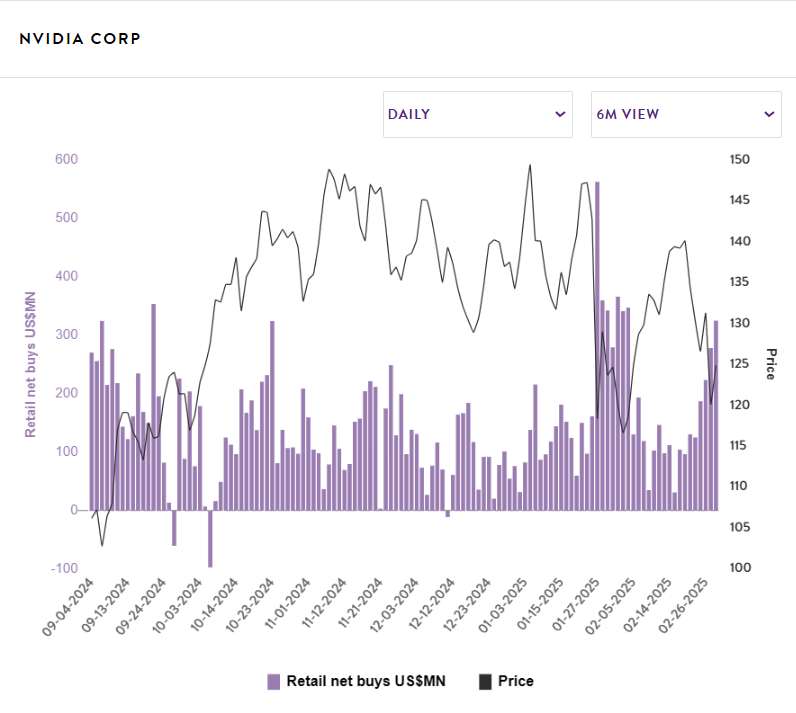

Unparalleled visibility into retail investor flows – stay ahead of the game with the most traded, bought and sold securities by global retail investors.

Daily options data for a unique point of view – our unique options data leaderboard provides call “Turnover” (or premium traded in US$) by global investors in all US-traded options.

Tailor and aggregate data so you don’t miss what matters to you – aggregate data by theme, sector, benchmark and factor to see what pockets of the market retail investors are rotating into. With alerts, receive daily or weekly alerts on major moves in retail flows and stocks you care about.

Deep market context, not just numbers – to provide you with trade ideas, we highlight opportunities and risks – in our bi-weekly VandaTrack Update report which provides curation and narrative around retail investors’ flow data seen by Vanda’s expert global research team.

See VandaTrack in action

To fully grasp the power of VandaTrack, seeing is believing. Explore interactive dashboards that provide deep insights into investor positioning and flow dynamics.